Broker-Dealer's Guide to Crypto Market Entry: White-Label, Internalization, or Hybrid?

Digital Asset Revolution 2025: The $350 Trillion Opportunity for Financial Institutions

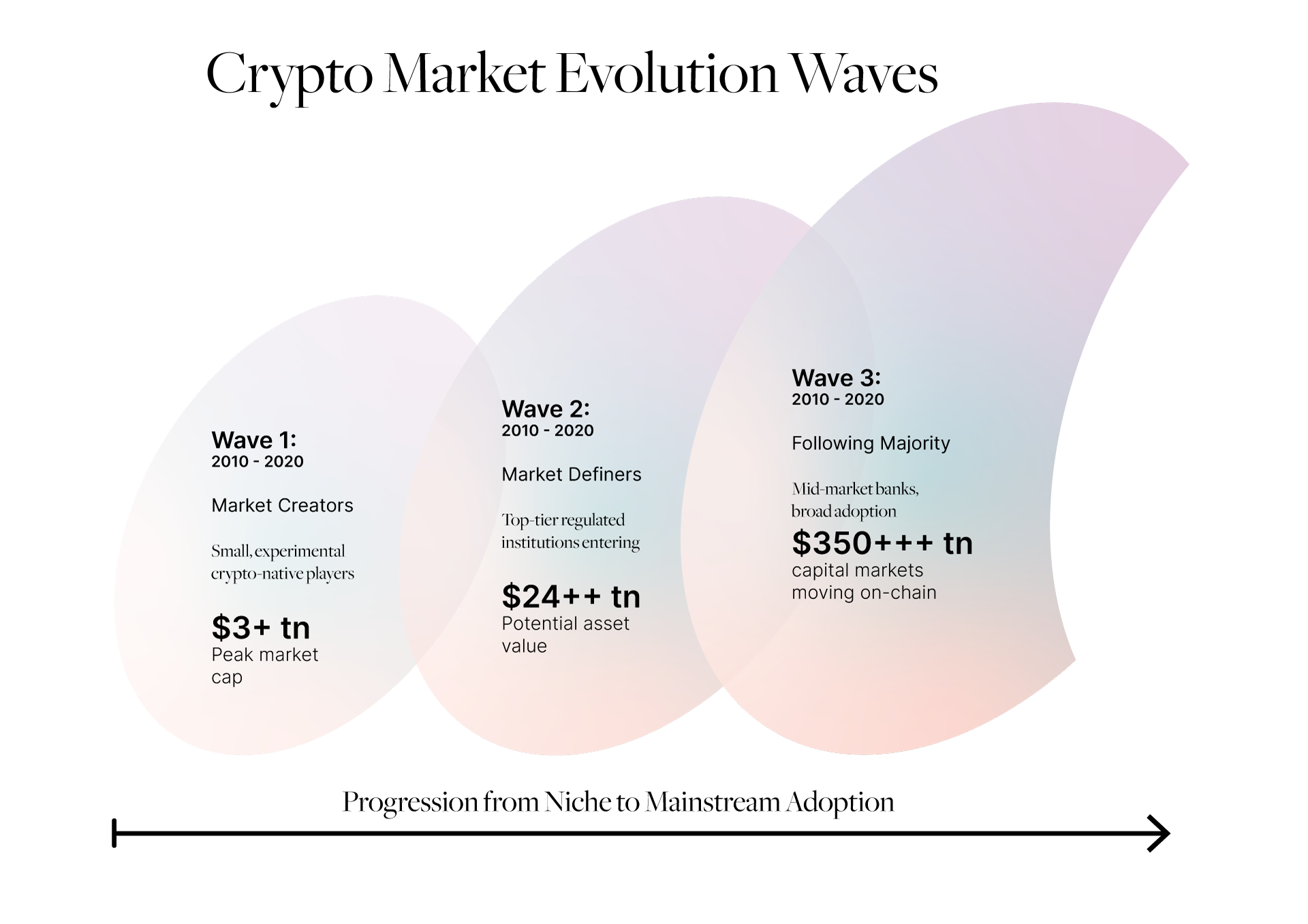

2025 is a pivotal year for banks, asset managers and fintechs. We at Aplo believe that this is the year when clinging to legacy systems is a fast track to irrelevance. It’s also a year when mid-market banks, intermediaries, and corporates foray into the digital asset space across a range of offerings, creating a $350T opportunity.

This comprehensive guide explores how broker-dealers can navigate the complex landscape of cryptocurrency offerings. We'll examine three integration models: white labeling, full internalization, and hybrid solutions—each with distinct operational frameworks, regulatory compliance requirements, and implementation strategies that define success in the digital assets ecosystem.

But before diving into the technical details and trading infrastructure requirements of these three key models, let's set the context.

Why Do Banks, Fintechs and Asset Managers Tiptoe Toward Crypto?

Not so long ago, bank executives would compete with one another to be the loudest critic of cryptocurrencies. Introduction of the Genius and Clarity Acts, alongside other events has made the wind blow in the opposite direction. Spearheading this new trend were neobanks, as least conservative participants of the market. They leapfrogged the entire system by building financial services that are faster, cheaper, and globally scalable from day one. Often, including crypto offerings for their customer base through integrated trading platforms.

Revolut in this sense was the first to enable crypto, allowing its users to transfer funds to/from major crypto exchanges (Coinbase, Binance, Kraken, Bitstamp, etc.). It is also possible to buy crypto directly from the Revolut account, by setting up an auto-exchange order at a set rate, and via a recurring buy feature that enables regular crypto investments. Revolut also supports real-time, cross-border payments via Lightspark, leveraging advanced payment gateways.

Stripe is letting businesses hold and move value in stablecoins across 101 countries, bypassing costly card networks. Banco Bilbao Vizcaya Argentaria (BBVA) among the first in Europe introduced digital asset custody services and blockchain-based loan programs. N26 has launched the crypto trading feature directly in their digital banking app, functioning as an integrated exchange platform. A total of 350 cryptocurrencies with fees ranging from 1.5% to 2.5%. Not to forget crypto-native "fintechs" like Coinbase and Circle that naturally move even faster.

Aplo's stance is quite expressive: sitting on the fence that would be widely regarded as neutral just one year ago is no longer neutral. Institutions waiting for a trigger may as well be relegated to the status of a "dinosaur," providing the slow, expensive settlement layer for nimbler competitors who own the client relationship and capture all the value.

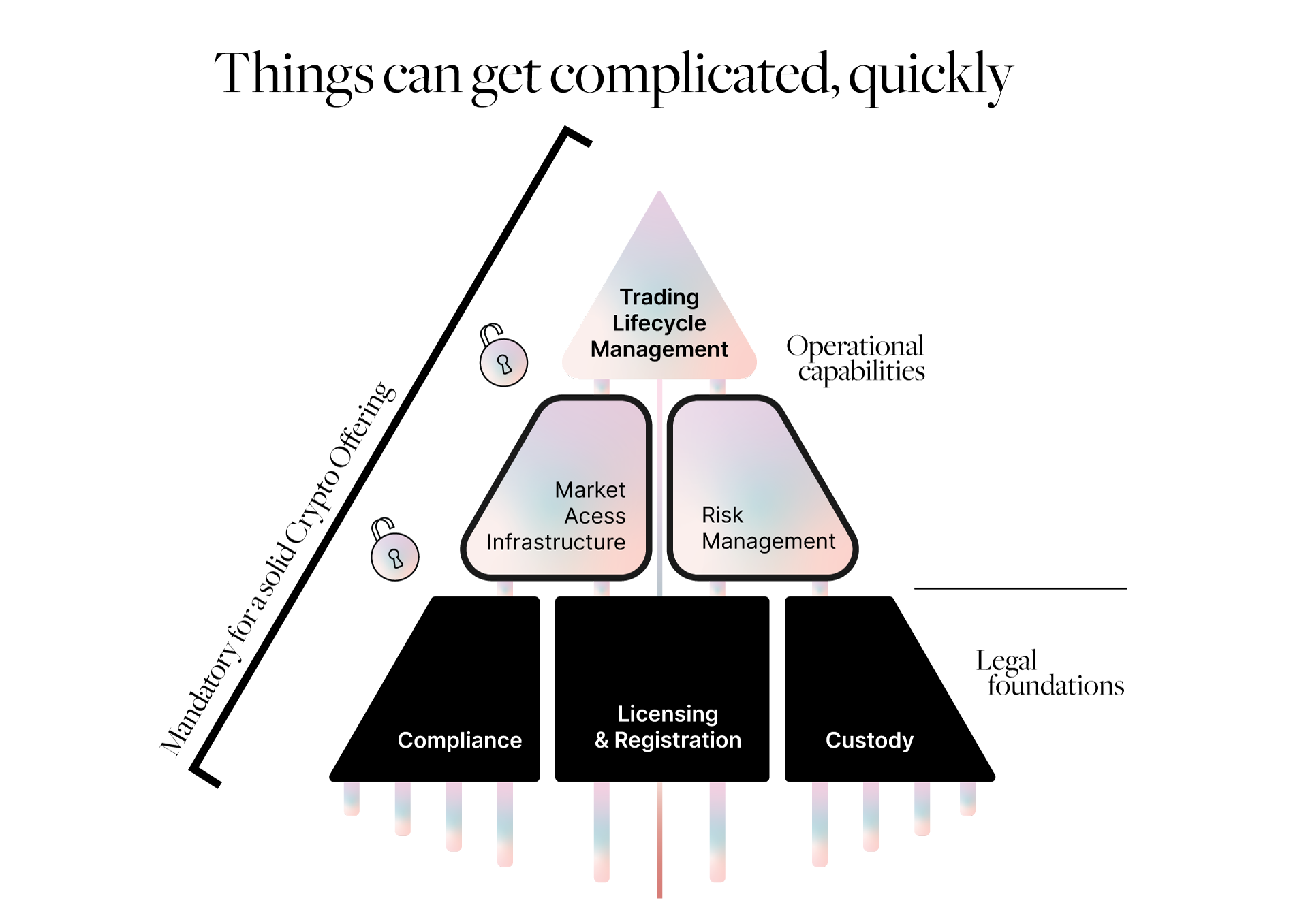

Your First Step into the Digital Asset Space: Building Compliant Trading Infrastructure

Before you commit to offering direct crypto access to your clients, there is a lower hanging fruit: servicing crypto-native companies.

- Fiat On/Off Ramps: Offering fiat banking to facilitate USD, EUR, or other currency transactions for crypto exchanges. This essential brokerage service creates seamless cryptocurrency transactions between traditional and digital finance.

- Prime Brokerage and Liquidity: Extending services like credit, settlement, and access to liquidity for institutional crypto traders. Banks with foreign exchange (FX) desks can integrate with digital asset networks to become liquidity providers themselves, offering deep liquidity pools to crypto market participants.

- Lending and Payments: Providing standard lending and payment services to established crypto firms, ensuring regulatory compliance throughout the process.

This way you leverage your existing infrastructure to generate new revenue while carefully managing risk exposure.

Closed-loop vs. Open-loop Trading Systems: Choosing Your Crypto Architecture

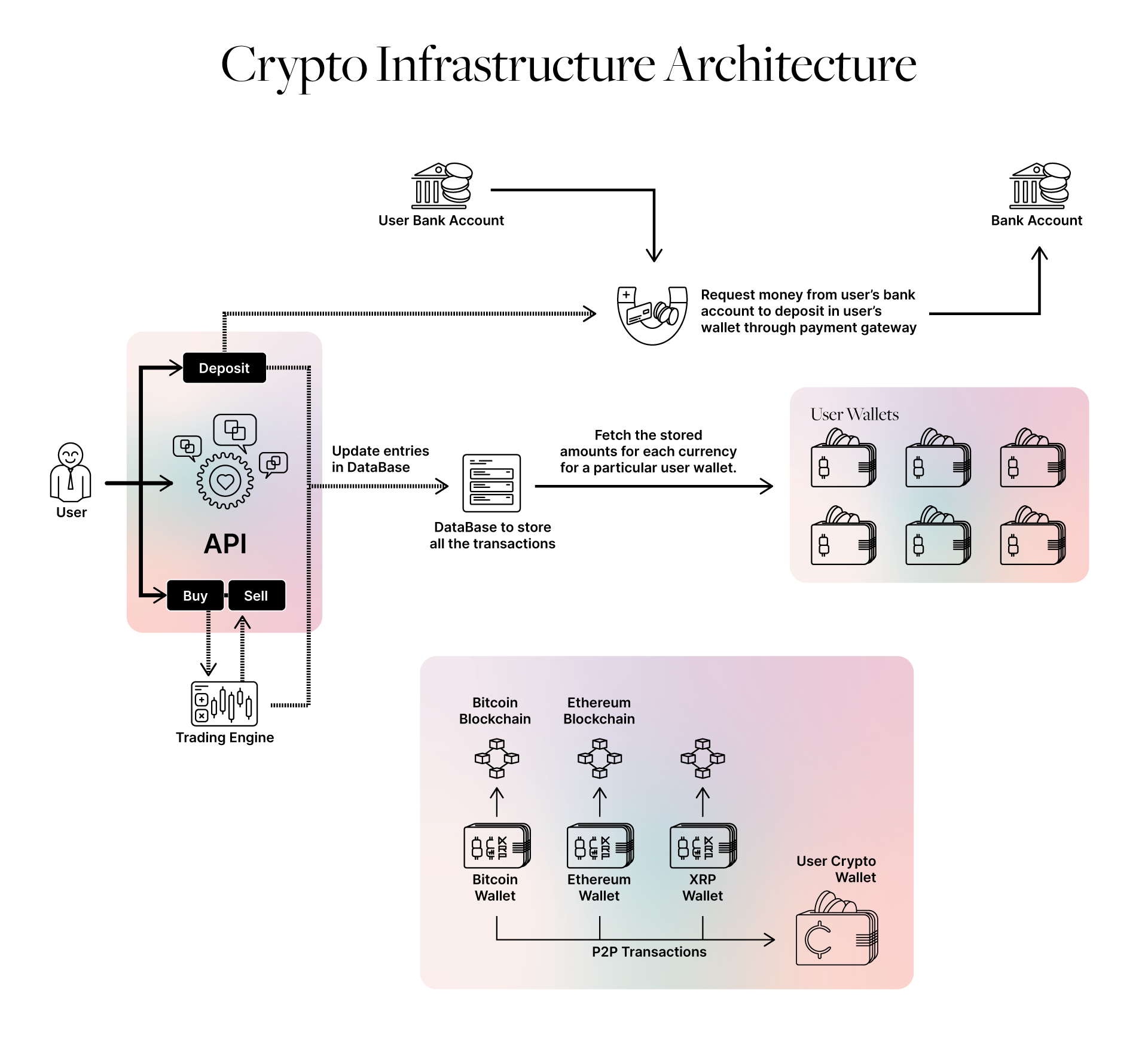

One step forward from servicing crypto firms is to create customer-facing crypto services. This way the bank allows its retail and institutional clients to buy, sell, and hold digital assets. A typical fork in the road for broker-dealers is whether to launch a closed-loop or open-loop system.

A closed-loop architecture is often a practical first step. In this model, clients can buy and sell crypto but cannot deposit or withdraw digital assets directly. All funds enter and exit the ecosystem as fiat currency. This approach significantly simplifies operational and regulatory compliance burdens, as it sidesteps the need for 24/7 crypto withdrawal operations and complex transaction monitoring with tools like Chainalysis or Elliptic.

An open-loop system, which allows for crypto deposits and withdrawals, offers a full-service experience but introduces greater complexity. A critical and often overlooked component of this pathway is digital asset custody. While institutions have long offered custody for traditional assets, crypto custody requires specialized technology. Often built in layered fashion where the bank itself manages the operational layer, and other layers are outsourced to technology providers like Fireblocks, DFNS or Lightspark for white-labeled crypto wallets, exchange API integrations, cybersecurity, and custody rails. By successfully combining custody with trading, broker-dealers can provide a seamless customer experience within a familiar and regulated environment. This can also be a gateway to offering more sophisticated crypto-linked structured products, expanding wealth management portfolios.

On the flip side, open loop systems introduce significant AML obligations, often requiring the integration of blockchain analytics tools like Chainalysis/Elliptic to screen all on-chain deposits and withdrawals for illicit activity, implementing robust security protocols while maintaining strict regulatory compliance.

With these in mind, let's elaborate on key integration models.

White Labeling: Leveraging Pre-Built Trading Platform Solutions

Many retail broker-dealers with traditional finance roots have turned to white label trading platform infrastructure to accelerate time-to-market. The appeal is clear: a turnkey solution, deployable in under six months, with minimal internal uplift. But this speed comes with strategic trade-offs.

White-label providers often position themselves as enablers, but many, such as Bitpanda or Trade Republic, are also direct competitors with their own large retail trading platforms. The strategic problem is rooted in a layered cost structure that creates an inherent disadvantage for the broker-dealer.

The white-label provider charges the broker-dealer a fee for using the service. The aforementioned provider would also charge the end client a fee, typically through spread markups of 1.5 to 3% on major trading pairs. Both of these costs are usually passed onto the end client.

The dilemma is therefore clear: you are offering the exact same service as your provider, but you can only be at least as expensive. To achieve any margin, you are forced to be more expensive. This fundamentally undermines your value proposition, as you are unable to compete on price.

Execution transparency is another pain point. Most white-label providers operate retail platforms that rely on a fee-plus-spread revenue model. When you license their infrastructure, you’re adopting their pricing structure, which is opaque by design. This limits your ability to provide clear execution data, and by extension, undermines your ability to differentiate on trust and transparency.

Customization is also more limited than it appears. While providers often advertise modularity, in practice, development priorities are shaped by their own product roadmap built around millions of direct retail users. Because serving a retail audience at scale is operationally heavy, providers must make specific design choices in their user flows and onboarding processes. They can't afford to be too flexible, as their retail-first approach dictates a standardized offering. This model, for example, contrasts with B2B-focused enablers like Paxos or ZeroHash, whose entire mission is to provide infrastructure without competing for the end user, allowing for potentially greater alignment.

White-labeling can be a viable strategy if crypto is a defensive move and you are not directly competing with the provider. For a large, established bank—such as a Crédit Agricole or BNP—whose client base is older and less volatile, white-labeling a solution from a digital-native platform may make sense, as their target markets rarely, if at all, overlap.

Full Internalization: Building Proprietary Trading Infrastructure

Full internalization gives broker-dealers complete control over their crypto infrastructure, where they operate proprietary desks, provide over-the-counter (OTC) liquidity, and/or act as market makers. For example, your internal desk might trade Bitcoin futures and options or facilitate large, bespoke crypto trades for institutional clients.

Implementation typically extends 18-24 months, requiring substantial investment in reliable and scalable systems for connectivity and execution, often leveraging a specialized Order and Execution Management System (OEMS) to connect to crypto exchanges, support smart order routing, and manage settlement. Internalization also invites the need for quantitative and operations teams to manage significant execution risks.

BBVA (launched its own Bitcoin and Ethereum brokerage service) and Deutsche Bank (custody) have pursued this path to varying degrees.

Building infrastructure in-house is profoundly complex because it forces an institution to solve systemic inefficiencies that traditional markets eliminated decades ago. A bank must integrate with a fragmented landscape of 5-15 exchange venues, each demanding bespoke legal agreements, KYC, and unique API integrations, which, in turn, requires building and maintaining replicated custody and funding rails for every connection. This challenge is compounded by a stark lack of data standardization; for instance, Bitcoin might have ten decimals on Coinbase, twelve on Binance, and only six on Kraken, forcing firms to build and maintain a data "translator" to keep information coming from cryptocurrency exchanges homogenous.

Fragmented structure further introduces acute financial risks: without a central clearinghouse, the firm must directly manage counterparty risk with each exchange, while slow cross-exchange transfers cripple capital efficiency and create significant hedging challenges. Risk is magnified by notoriously unreliable APIs that often drop with a weekly cadence, and the general lack of contractually binding Service Level Agreements (SLAs) in the space. A provider's API may be technically "available," but the underlying service could be malfunctioning, creating a constant threat of failed trades and unhedged positions that can quickly escalate into substantial operational losses.

A primary, and often underestimated, danger is the risk of a negative operational profit and loss (P&L). This occurs when something goes wrong in the trading workflow, causing the broker-dealer to unintentionally take on risk on its balance sheet. That risk usually results in a loss. For example, you are matching the client based on wrong information from your own fills in the market. If a client has bought 0.1 BTC at $100,000, you think they bought 0.1BTC on the market at $100,000 but orders didn't get filled. So you are forced to buy 0.1BTC at $105,000 one hour later. You, as a broker-dealer, just made a loss.

Operational failures together with a steady drain from low quality execution — such as a router consistently causing slippage — can compound into hundreds of thousands in financial damages.

Despite these risks, this approach enables comprehensive transparency and differentiation. The decision to internalize makes the most sense when a firm has a massive and sticky client base or if it plans to leverage the infrastructure as an asset that can be white-labeled to other, smaller players. As in traditional finance, not every bank builds its own equity execution stack; many outsource to the likes of BNY Mellon or CACEIS. The same logic applies here.

Hybrid Models: Balancing Control and Efficiency

Hybrid models balance control and efficiency by combining internal regulatory oversight with outsourced trading infrastructure. Implementation timelines typically range from 4 to 8 months, faster than full internalization while providing greater strategic autonomy than white-label solutions.

The broker-dealer serves as the legal counterparty to clients, maintaining regulatory compliance and branding control. In parallel, operational complexity like execution, settlement, and reporting is delegated to a partner like Aplo. This structure is effective because the partner operates as a wholesaler. Freed from the immense operational overhead of managing thousands of retail clients, a wholesale provider can focus on its core competencies—execution, trade operations, and risk management—making the service cheaper, more robust, and more efficient. This setup enables broker-dealers to meet client demand without building or staffing a dedicated crypto trading desk. A real-world case study is one of our clients — Deskoin, which utilized a hybrid model to launch its crypto offering.

Operational resource requirements are minimal, typically around 0.5 full-time equivalents, due to the efficiency gained from outsourcing technical operations while retaining control over compliance, client relationships, and product strategy.

Hybrid models offer a clear advantage in transparency and differentiation. Unlike conventional white-label offerings, they support detailed execution reporting, customizable client experiences, and flexible integration. Because the wholesale provider serves fewer, larger clients, they can afford to build custom workflows and adapt to each partner's unique systems.

Scalability is also enhanced. Broker-dealers can launch focused products with limited scope and expand over time based on client demand, without proportionate increases in operational burden. This evolutionary path allows resource allocation to track business traction, reducing risk while preserving upside.

The hybrid model is particularly pragmatic in the EU under current regulatory frameworks.

Under MiCA's Rule 60, some financial institutions like banks or MIFID-regulated investment firms don't need to undergo a full, lengthy licensing process to offer crypto services. Instead, they can simply notify their regulator and go live within 45 days. This dramatically reduces regulatory friction and makes it possible for firms to launch offerings with minimal legal lift.

In contrast, new entrants or firms without these specific, pre-existing licenses must complete the full CASP licensing process. This means an institution's existing regulatory compliance status may be attributed to cost, time, and operational complexity of launching a crypto offering.

Even with MiCA in place, compliance is not a simple checklist. Overlaps with other frameworks like the Capital Requirements Regulation/Directive (CRR/CRD) or the Anti-Money Laundering Directive (AMLD) mean that firms must build cross-regulatory compliance frameworks, not just MiCA-specific ones. The key challenge is integrating these different regulatory standards while anticipating how supervision and enforcement will evolve across EU member states.

Wrapping Up: The Future of Digital Asset Trading Infrastructure

Either white-label, full internalization, or hybrid—these are not items for a future agenda; they are the entry points to internet capital markets. The financial system as we know it is being rebuilt in real time, and the window for strategic deliberation is closing.

While some institutions weigh the options, others are capturing the cryptocurrency market.

PayPal is building a "payments superchain" on the OP Stack to optimize its PYUSD stablecoin for real-time transfers through advanced payment gateways. Coinbase is capturing value at the protocol level with its own blockchain, Base, earning sequencer revenue from every transaction that runs on its rails. Robinhood has already announced its own L2 to internalize more value and enhance the user experience. Goes on the list: Circle's proprietary blockchain layer called Arc, IB eyeing crypto to fund brokerage accounts 24/7, and corporate adoption that has exceeded $115B in market capitalization.

The question is no longer if blockchain technology will disrupt your revenue model, but how exactly. The choice is yours to make.